U.S. gas futures this week collapsed to a three-year low, while spot prices were on track to post their weakest summer in over 20 years. In other markets, such lackluster pricing would cause investment to retrench and supply to contract.

But gas production is at a record high and expected to keep growing. Demand is rising as power generators shut coal plants and burn more gas for electricity and as rapidly expanding liquefied natural gas (LNG) terminals turn more of the fuel into super-cooled liquid for export.

Analysts believe the natural gas market is not trading on demand fundamentals because supply growth continues to far outpace rising consumption. Energy firms are pulling record amounts of oil from shale formations and with that oil comes associated gas that needs either to be shipped or burned off.

On the New York Mercantile Exchange, gas futures NGc1 this week dropped to $2.03 per million British thermal units (mmBtu), the lowest since May 2016. For the summer, spot gas prices at the Henry Hub NG-W-HH-SNL benchmark in Louisiana were on track to fall to their lowest since 1998.

Gas speculators last week boosted their net short positions to the highest on record, according to the U.S. Commodity Futures Trading Commission.

“All the bulls are gone,” said Kyle Cooper, a consultant at ION Energy in Houston.

The market is expecting a big boost in gas output this fall after Kinder Morgan Inc’s (KMI.N) Gulf Coast Express pipeline comes online in September and releases some of the gas currently stranded and being burned in the Permian.

So much associated gas is coming out of the ground that gas prices in the Permian basin in Texas and New Mexico, the biggest U.S. shale oil formation, have turned negative on multiple occasions this year.

Meg Gentle, CEO of U.S. LNG company Tellurian Inc (TELL.O), said current pipeline expansion plans will not meet record gas production in the Permian, leading to severely depressed prices at the Waha Hub in West Texas, which touched a record low of negative $9/mmBtu in April.

“Negative $9. I’d be happy taking it all for $1,” Gentle said earlier this year at a conference. Tellurian is developing the Driftwood LNG export plant in Louisiana and pipelines to transport gas from fields like the Permian to the Gulf Coast.

The rising production has offset a nominally bullish factor like persistently low inventories. While recent declines in oil and gas prices have prompted energy firms to cut spending on new drilling, a drop in production growth is still considered far away. [EIA/GAS] [RIG/U]

The U.S. Energy Information Administration projects gas production will rise 10% to 91 billion cubic feet per day in 2019 after soaring 12% to a record 83.4 bcfd in 2018, its biggest annual percentage increase since 1951.

One billion cubic feet is enough gas to fuel about five million U.S. homes for a day.

LNG ISN’T ENOUGH

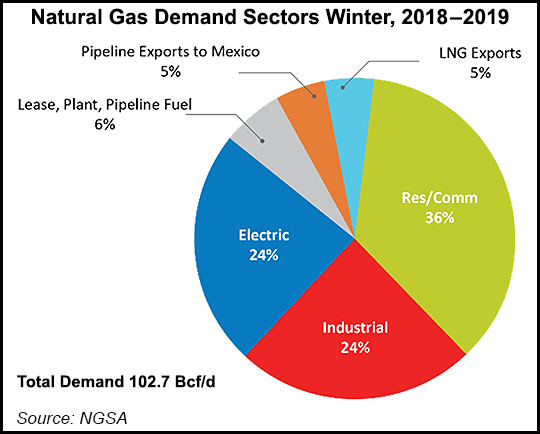

U.S. LNG exports, particularly to Asia, are powering increased demand. They are expected to rise from a record 3.0 bcfd in 2018 to 6.9 bcfd in 2020, according to EIA projections, making LNG the nation’s fastest-growing source of demand. Still, LNG exports account for only about 5% of total U.S. gas use.

“LNG is still not a significant enough portion of the consumption pie to independently push prices higher,” said Jim Ritterbusch of Ritterbusch and Associates of Galena, Illinois.

Meanwhile, U.S. power generators’ gas use may be peaking, rising to an expected record 30.6 bcfd in 2019 but then falling to 29.6 bcfd in 2020 as renewables produce more electricity, EIA data shows.

Daniel Myers, market analyst at Gelber & Associates in Houston, said “persistent low prices are beginning to crimp producers’ growth expectations” in gas-heavy shale formations such as the Marcellus in Pennsylvania or the Haynesville in Texas, Louisiana, and Arkansas.

But the sheer volume of gas produced in oil-heavy plays like the Permian means that supply could remain robust.

“Production in the Permian is nearly entirely oil-driven and independent from gas prices,” said Myers.

*Scott DiSavino; Stephanie Kelly; Editing: Dan Grebler – Reuters

No comments:

Post a Comment