Oil prices rose on Thursday as oil workers evacuated rigs in the U.S. Gulf of Mexico ahead of Hurricane Delta, though fuel demand concerns persisted on fading chances for a U.S. economic stimulus deal and after a build in U.S. crude inventories.

U.S. West Texas Intermediate (WTI) crude futures rose 27 cents, or 0.68%, to $40.22 a barrel at 0649 GMT, after falling 1.8% on Wednesday.

Brent crude futures rose 31 cents, or 0.74%, to $42.30 a barrel, after falling 1.6% on Wednesday.

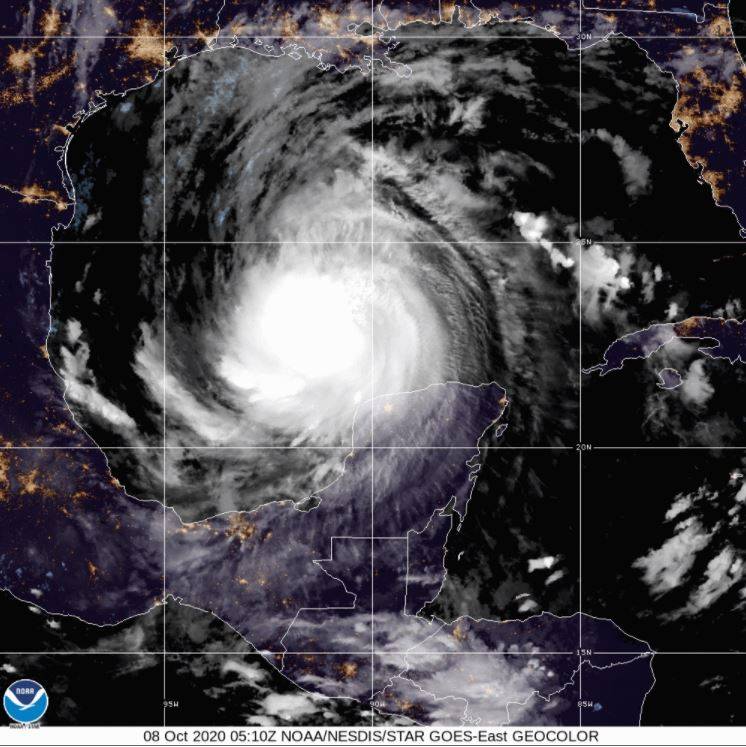

With Hurricane Delta forecast to intensify into a Category 3 storm with winds of up to 120 miles per hour (193 km per hour), oil producers such as Chevron Corp have evacuated 183 offshore facilities and halted nearly 1.5 million barrels per day (bpd) of oil output.

The Gulf of Mexico produced 1.65 million bpd in July, according to the U.S. government. The region, which accounts for 17% of U.S. crude output, has been hit by several storms over the past few months, each of which only briefly dented oil output.

Potential production outages in Europe's North Sea because of a Norwegian workers' strike were also supporting prices.

The Johan Sverdrup oilfield, the North Sea's largest with an output capacity of up to 470,000 bpd, will have to close down production unless the strike ends by Oct. 14, field operator Equinor said.

ConocoPhillips will close down production at Norway's Ekofisk 2/4 B platform if the strike goes ahead as planned on Oct. 10.

On the demand side, hopes for a further pick-up in U.S. fuel demand faded as White House officials reiterated on Wednesday that "stimulus negotiations are off" a day after President Donald Trump halted talks on a broad relief package.

The possibility that there will be no upcoming economic support measures comes as government data on Wednesday showed demand for oil at U.S. refineries is 13.2% lower than a year earlier, underscoring the plunge in fuel demand from the disruptions caused by the coronavirus pandemic.

"A piecemeal approach to U.S. fiscal stimulus is unlikely to alter a deteriorating demand outlook for oil," ANZ commodities analyst Vivek Dhar said in a note.

The Energy Information Administration data on Wednesday did show U.S. gasoline stocks fell more than expected last week to their lowest since November, and distillate stockpiles also declined. However, crude oil supplies rose by 501,000 barrels, as production and imports climbed.

(Reporting by Sonali Paul and Shu Zhang; Editing by Christian Schmollinger)

No comments:

Post a Comment