Credit: Equinor

Norwegian oil and gas company Equinor has decided to write down the book value of its Tanzania LNG project (TLNG) on the company’s balance sheet by $982 million.

The company said Friday that while progress has been made in recent years on the commercial framework for TLNG, overall project economics have not yet improved sufficiently to justify keeping it on the balance sheet.

"The TLNG project has an anticipated breakeven price well above the portfolio average for Equinor and is, at this time, not competitive within this portfolio. Equinor will continue to engage with the Government of Tanzania in negotiations on a commercial, fiscal and legal framework that may provide a viable business case for TLNG in the future," Equinor said.

"Equinor maintains an attractive portfolio of project development opportunities in oil and gas as well as renewables. This portfolio requires strict prioritization, ensuring capital is allocated towards projects yielding the most competitive returns," it added.

"As shown at the Capital Markets Update in February last year, Equinor’s oil and gas projects with expected start-up by 2026 have an average breakeven below $35/bbl based on today’s estimates. Similar for non-sanctioned oil and gas projects with expected start-up within this decade, the average breakeven is below $40/bbl," the company said.

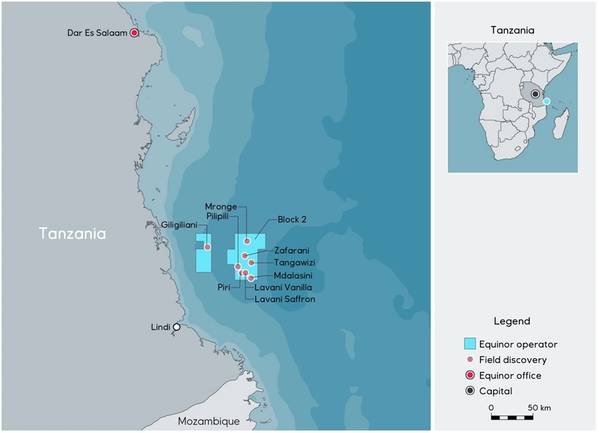

The Norwegian oil and gas firm has been present in Tanzania since 2007 when the company signed a Production Sharing Agreement (PSA) with the Tanzania Petroleum Development Corporation (TPDC).

Equinor is the operator with a 65% participating interest, along with ExxonMobil’s working interest of 35%. TPDC has the right to participate with a 10% interest.

Equinor started exploration drilling in Block 2 Offshore Tanzania in 2011. A total of 15 exploration wells have been drilled, resulting in nine discoveries with estimated volumes of more than 20 Tcf of gas in place.

No comments:

Post a Comment