Despite being the second-largest global market for onshore wind, the United States is today a very minor player in comparison to the European and East Asian offshore wind markets, however, this is about to change.

Philip Lewis, Director of Research, World Energy Reports said in an interview with Maritime Reporter TV, that 2021 is expected to be a "step-change" for the U.S. Offshore wind industry.

But first, where are we today? Per Lewis, the U.S. currently has only two operational projects for a total of 42MW of installed capacity versus a global offshore installed base of 34,000MW or 34GW by the end of 2020. However, things are expected to accelerate from 2021 onwards.

"At World Energy Reports, we are forecasting that 2021 will deliver a step-change in offshore wind activity in the US as the journey accelerates to develop the 27GW project pipeline within this decade," Lewis said.

One project, Ohio’s Great Lakes 21MW Icebreaker, is already approved and addressing final challenges, he added.

"Short to medium term activity will be delivered by 11 Northeast and Mid-Atlantic projects that are seeking federal construction permits, known as the COP stage, for ~9GW," Lewis said.

He also said that, at World Energy Reports, there is a belief that President Joe Biden's last week's executive order will provide an impetus to accelerating the federal project environmental impact assessments and construction approval process for these imminent projects that will, in turn, drive the developing Made in America domestic supply chain and support local jobs.

Biden last week signed an executive order instructing the Secretary of the Interior to identify steps that can be taken to double renewable energy production from offshore wind by 2030.

Further, Lewis said, there is a medium-term pipeline of 15 projects for close to 15.5GW located within secured federal leases and are in the site assessment phase, known as the SAP stage, and a further group of six projects at early stage planning for nearly 2.7GW. These projects are underpinned by state procurements, either already committed or planned.

Longer-term: New York, California, Hawaii, and even Louisiana

According to Lewis, longer term, a clear pipeline will come from projects coming from future offshore leases from the New York Bight on the Atlantic Coast, Humboldt and Morro Bay off California, Oahu North and South off Hawaii and later Oregon in the Pacific and even Louisiana in the Gulf of Mexico. Per EIA, Louisiana ranks among the top 10 states in both crude oil reserves and crude oil production, accounting for about 1% of both U.S. total oil reserves and production.

The areas mentioned above are subject to federal preparatory activities in advance to lease activities and will drive project activity in the 2030’s.

Investment of $86 Billion - 2,000+ wind turbines

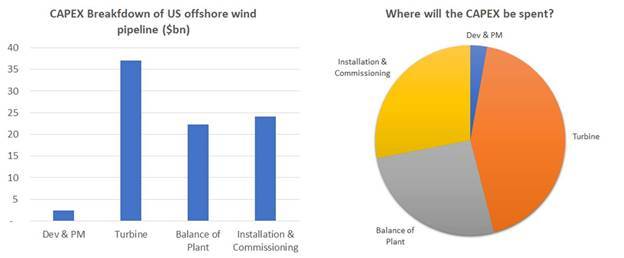

The 27GW Atlantic Coast pipeline calls for over $86bn of CAPEX and a recurring annual OPEX of $2.5bn a year once delivered.

The 2,000 plus wind turbines forecast to be manufactured represent the single largest CAPEX forecast, covering $35bn of wind turbine component supply.

Of this amount, some $2.6bn forecast CAPEX will be needed to manufacture the towers sitting on top of the foundation monopile or jacket transition pieces that support the turbines. Plans have already been announced for one factory in upstate New York and we see that further opportunity remains for domestic supply of this component. Lewis said.

"The 2,000 plus wind turbines will be supported by over $5bn of steel monopile and jackets foundations or concrete gravity base foundations and connected to each other and to shore by over $6bn of array and export cable supply, as part of the over $22bn balance of plant category," Lewis added.

Per World Energy Reports, over $24bn of CAPEX will be spent on installation and commissioning activities, including over $8bn on cable installation, $3.7bn on foundations installation, and over $1.8bn on turbine installation.

"These projects provide a significant domestic opportunity for engineering companies, manufacturers, contractors, vessel operators, survey and inspections companies as well as for project lenders," Lewis said.

45 ports in nine states suitable for offshore wind work

To support the expected uptick in offshore wind activity, World Energy Reports has analyzed the port infrastructure development plans and has identified over 45 ports in nine states as possible options for marshaling and construction activities, with already over $1bn of CAPEX identified to develop the infrastructure in identified ports. In addition to this, WER identified 38 locations as possible O&M bases.

"Once the projects in the pipeline are delivered, we forecast an annual recurring Operations and Maintenance OPEX of around $2.5bn, of which around $1.2bn will be required for turbine maintenance and servicing, and $650m for the foundations, cables, and substation maintenance, which includes an amount of vessel chartering of crew transfer vessels (CTV) and service operations vessels (SOV). Outside of the turbine maintenance work, we expect an additional $60m recurring annual offshore and onshore logistics activity," Lewis said.

Reviewed by Crude Oil Facilitators

on

10:49

Rating:

Reviewed by Crude Oil Facilitators

on

10:49

Rating:

No comments:

Post a Comment